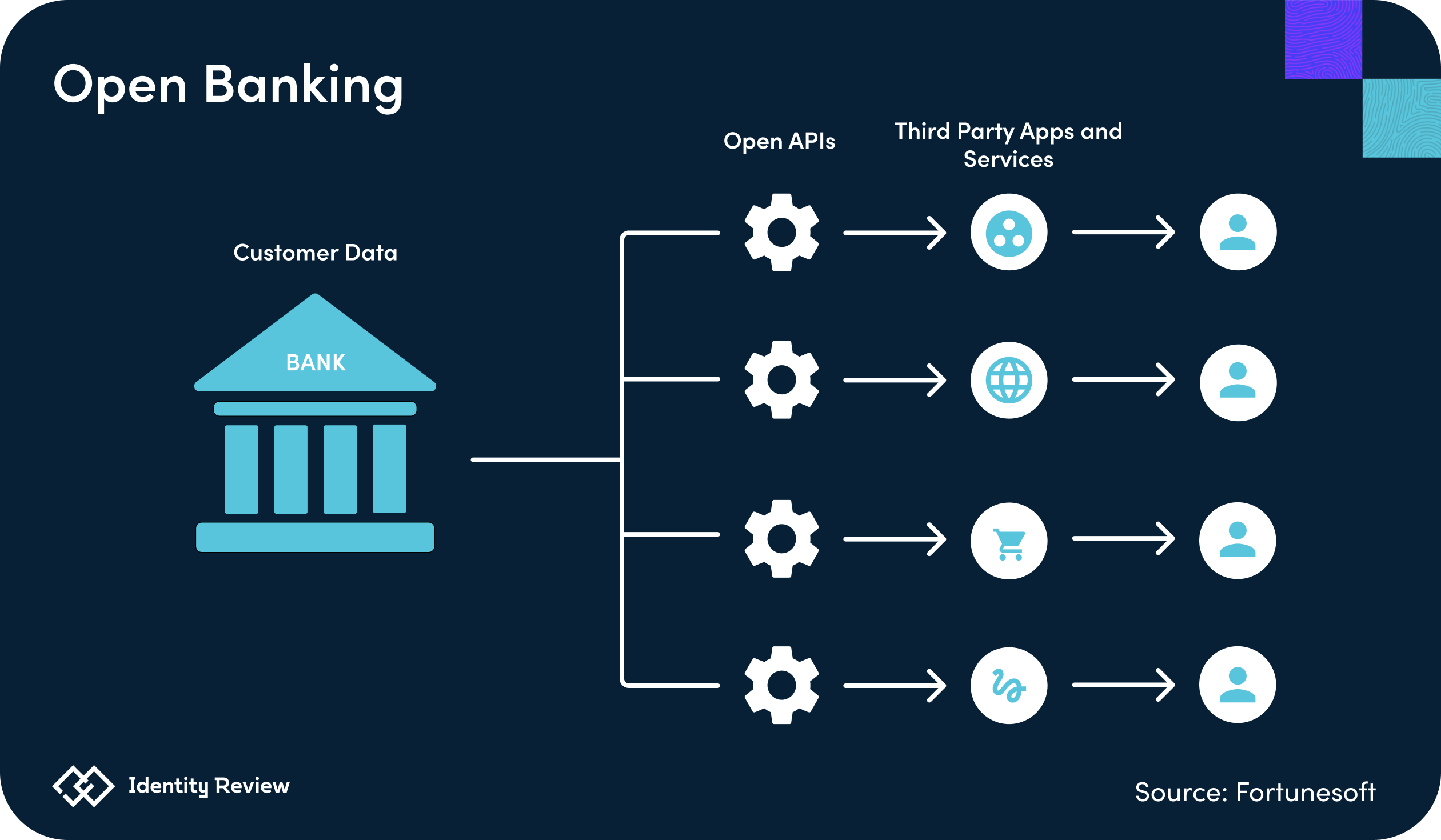

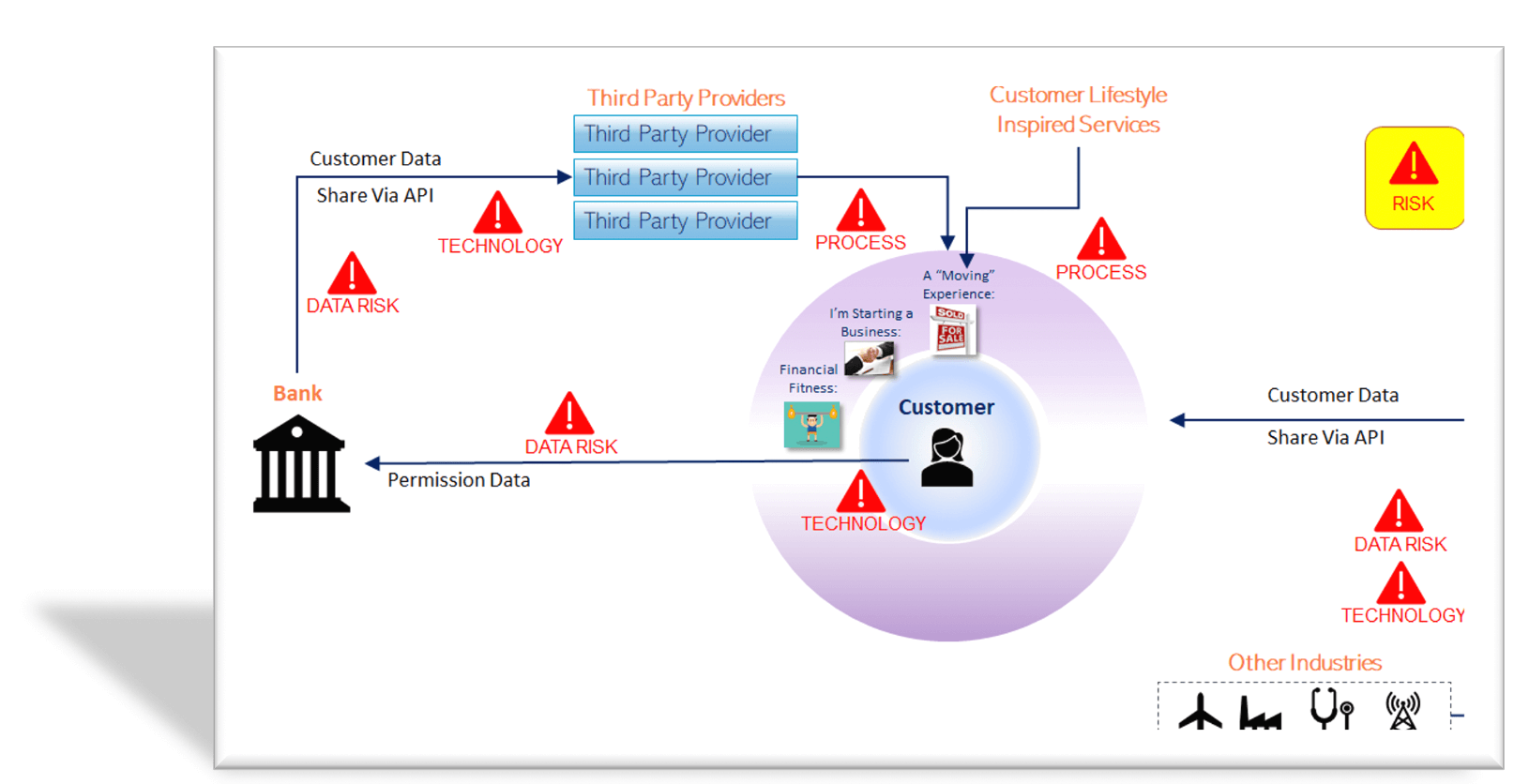

In an era where digital transformation dictates the pace of advancements in the financial services sector, the concept of open banking has emerged as a beacon of innovation, promising to reshape the consumer banking experience. However, this transformation is not without its challenges. A recent report sheds light on a growing concern among financial institutions (FIs) regarding the delicate balance between embracing open banking and mitigating the risks of accelerated fraud.

The Concerns Cast a Shadow on Open Banking’s Promise

A study titled “How Fraud Fears Impact FIs’ Adoption of Faster Payment Solutions,” conducted by PYMNTS Intelligence, uncovers a significant apprehension among nearly half of financial institution executives. These executives fear that the potential for fraud in an open banking environment could overshadow the benefits it offers.

The survey, which involved executives from 200 U.S. FIs, reveals that 46% of respondents view the risk of fraud as a formidable barrier that outweighs the advantages of the new feature. This percentage rises to 57% among FIs already grappling with high levels of fraud.

The promise of this new banking system, as advocated by the Consumer Finance Protection Bureau (CFPB), lies in its potential to supercharge competition, enhance financial products and services, and eliminate unnecessary fees, thereby empowering consumers to choose the best possible options.

CFPB Director Rohit Chopra emphasizes open banking’s role in promoting consumer choice and improving service quality. However, the skepticism among FIs highlights a critical debate: Can the financial sector harness the benefits of open banking without falling prey to its vulnerabilities?

If onboarding gives your users a headache. Open banking is a painkiller! 🥰

This saves time and reduces the risk of user loss for businesses.

🚧WIP series! pic.twitter.com/SFCU7QeiZV

— Mídé || Min. of Clean & Func. Design👨🎨 (@mide_ajibade) March 10, 2023

A Mixed Response from the Financial Sector

The report indicates a dichotomy within the financial sector regarding open banking’s adoption. Smaller FIs seem to be more optimistic, viewing it as an opportunity to gain a competitive edge. In contrast, larger FIs, especially those managing assets over $100 billion, express caution, citing the enhanced risk of fraud as a significant concern.

This cautious stance is particularly pronounced in discussions around payment speeds. While consumer demand for faster payments is undeniable, 52% of FIs worry that this will introduce new vulnerabilities to fraud, potentially exacerbated by open banking frameworks.

Despite these concerns, a notable 81% of respondents believe in their ability to provide secure real-time payments, indicating a confidence in existing security measures and the potential for technological solutions to mitigate risks.

The Role of Technology in Mitigating Fraud

The adoption of advanced technologies such as cloud-based security systems, artificial intelligence (AI), and machine learning (ML) is seen as a crucial factor in navigating the challenges of open banking. FIs that have already embraced these technologies exhibit greater confidence in their ability to manage fraud risks effectively.

This suggests a path forward for the industry: by investing in sophisticated fraud prevention technologies, even the most skeptical FIs can prepare themselves for the inevitable shift towards open banking.

The Path Forward

As the financial industry stands at the crossroads of innovation and security, the journey toward open banking illustrates the complexities of modernizing financial services. The concerns over fraud highlight a crucial need for a balanced approach that does not stifle innovation but rather fosters a secure environment for its evolution.

By leveraging cutting-edge technologies and fostering a culture of vigilance, the financial sector can navigate the challenges of open banking, ensuring that its promises are realized without compromising the security and trust of its customers.

The path to embracing open banking is fraught with challenges, but with the right strategies and technologies, the financial industry can turn these obstacles into stepping stones toward a more inclusive, efficient, and secure financial ecosystem.