Rivian Automotive, a prominent player in the electric vehicle market, faces a delicate balance of aggressive growth and financial sustainability. Despite its popularity, Rivian struggles to match production costs with sales revenue, leading to significant financial losses.

Here’s a deeper look into Rivian’s current predicament and its strategies for a more stable future.

Rivian’s Financial Performance: A Closer Look

Rivian reported a mixed bag of results in the first quarter. The company’s revenue saw an impressive 82% increase year over year, reaching $1.2 billion, with vehicle deliveries up by 71% to 13,588 units. Production also ramped up by 49% from the previous year to 13,980 vehicles.

Despite these growth indicators, the company’s financial health is under scrutiny as it continues to sell its vehicles at a loss — $38,784 less than the cost of production per vehicle. This shortfall is further exacerbated by additional costs tied to new technology implementations, which cost the company an additional $9,346 per vehicle delivered.

The luxury electric vehicle maker’s 2024 R1S model, a three-row SUV priced above $70,000, emerged as the best-selling EV in its category in the U.S., bolstering the brand’s market position as the fifth top-selling EV manufacturer in the country.

However, these achievements haven’t translated into profitability, with the company posting a staggering $527 million negative gross profit and an operating loss of $1.48 billion. The adjusted EBITDA further reflected a loss of $798 million.

Navigating Cash Flow Challenges

Rivian’s strategy of selling below cost has led to substantial cash outflows. In the last quarter alone, the company experienced operating cash outflows of $1.26 billion, combined with capital expenditures of $254 million, resulting in a free cash flow of negative $1.51 billion.

With $7.86 billion in cash reserves juxtaposed against a $4.43 billion debt load, the company’s financial runway is under severe pressure, forecasting a potential cash depletion by early next year without strategic intervention.

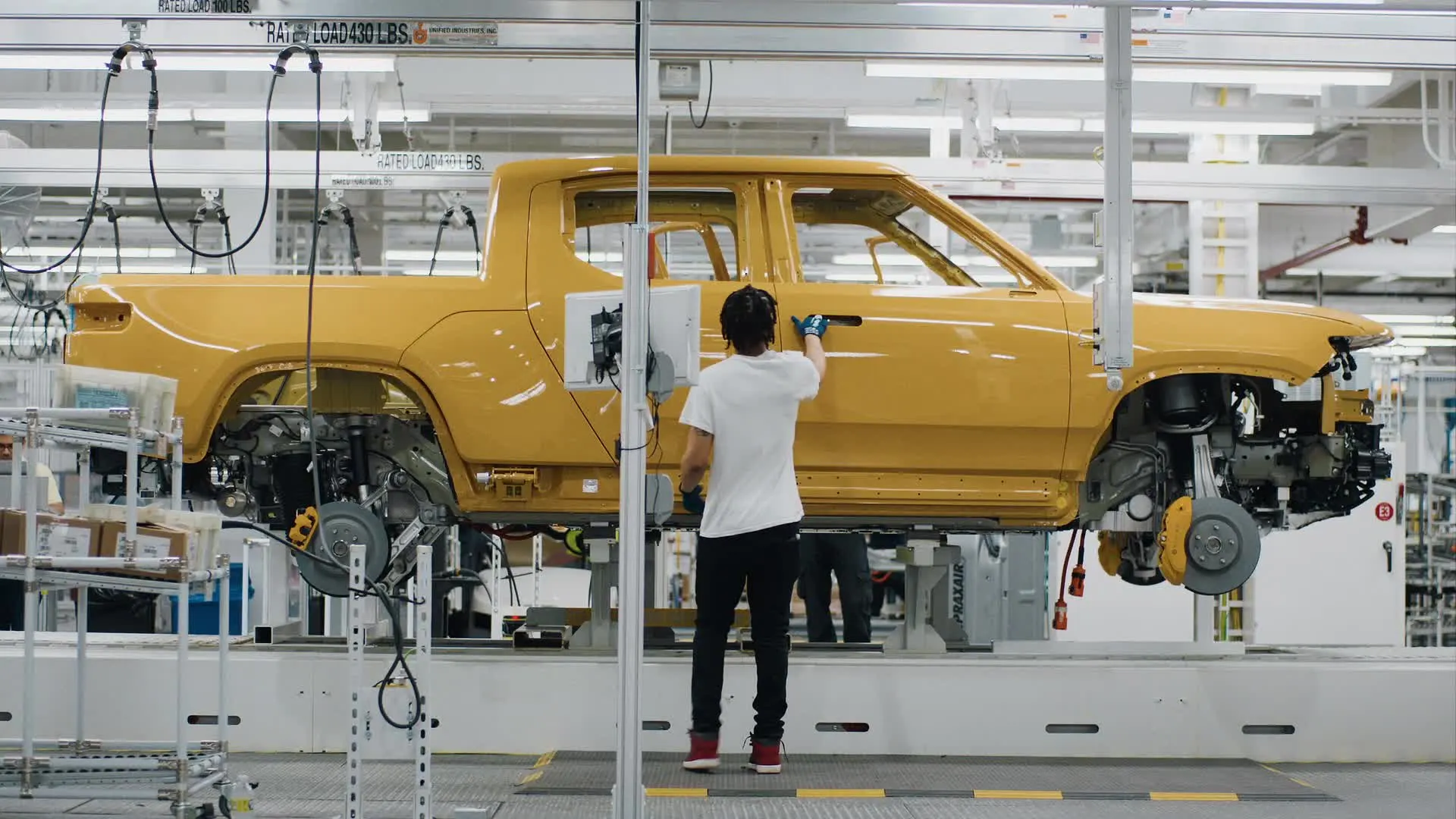

In response, the brand is pushing for cost-reduction measures, including a retooling upgrade at its manufacturing plant expected to increase production efficiency by 30%. Material changes and a shift to zonal network architecture are anticipated to decrease the number of electronic control units in its vehicles by 60%, aiming to curb production costs significantly.

Future Prospects and Adjustments

Looking ahead, Rivian projects achieving a modest gross profit by the fourth quarter of this year. The company has revised its capital expenditure forecast for 2024 down by $550 million to $1.2 billion and anticipates $100 million in cash incentives from the state of Illinois for its plant expansion efforts.

These measures are expected to reduce the company’s quarterly cash outflows to around $1 billion by year-end, with a slight increase in capital expenditures to $1.5 billion projected for 2025.

Rivian remains optimistic about reaching cash-flow positivity once annual production hits 215,000 units at its Normal, Illinois facility, not accounting for further capital expenditures on new production capabilities.

Despite over $4 billion in debt, the likelihood of an equity raise seems a strategic choice given prevailing high interest rates, though it would dilute current shareholder value.

Financial Performance and Forecasts:

Rivian is operating at a loss of over $600 million on 8,000 units delivered, showing improvement from the previous quarter's $760 million loss on similar delivery volume.

The company's gross profit outlook for Q4 of 2024…— LongYield (@LongYield) May 21, 2023

The Rivian Edge: Strategic Partnerships and Market Position

Rivian continues to hold significant promise in the EV sector, backed by robust partnerships and innovative products. Its collaboration with Amazon, its largest shareholder, provides a cushion that might lead to further financial backing to safeguard both the partnership and Amazon’s investment.

This relationship sets Rivian apart from other emerging EV startups and might be a pivotal factor in its long-term success.

Investment Considerations

While Rivian presents a high-risk/high-reward investment proposition, potential investors should weigh the company’s market position, innovative product line, and strategic partnerships against its current financial volatility.

As Rivian navigates through its financial challenges with strategic adjustments, the broader question remains: Will these efforts suffice to stabilize the company’s future, or is the financial strain too great to overcome?